Card issuing platform built for innovation and scale

Launch and service credit card programs through any issuer. Support co-branded cards, virtual card issuance, and private label programs with complete API control.

A unified platform to launch credit cards

Our credit card issuing platform provides the building blocks for next-gen card programs. From co-branded credit cards to white label solutions, our card issuing software supports any credit structure you can imagine.

Origination Suite

Connect to any issuer, underwriting tool, and decisioning engine through LoanPro's API-first card issuing platform. Issue virtual cards instantly for digital-first customers.

Modern Lending Core

A reliable foundation that tracks all card events in our Real-Time Ledger while using Compliance Safeguard to keep you in line with the CARD Act and other regulations.

Servicing Suite

Our credit card servicing software automates customer account management, from payment processing to due date changes and credit adjustments.

Collections Suite

Provide payment flexibility and hardship programs for customers who are past due on payments.

Payments Suite

Process credit card payments securely with our PCI-compliant card payment processing platform. Store tokenized payment profiles in our patented Adaptive Wallet for seamless AutoPay setup.

The tools necessary to launch fully configurable credit cards

Transaction-level credit

Apply unique interest rates to specific merchants, categories of transactions, geolocations, or more (patent-pending innovation).

Agent Walkthroughs

Create and customize step-by-step guides that lead agents through any process.

Swipe data enrichment

Enrich your transaction data to understand merchants, categories of spend, geolocations, and other insightful data points.

Bring-Your-Own-Issuer

Seamlessly integrate the issuing processors of your choice into LoanPro’s modern, API-first platform.

Sub-lines

Full support for unlimited sub-lines within a master line, with unique rules for each sub-line.

Automation Engine

Put servicing on autopilot through rule-based automations that run in the background.

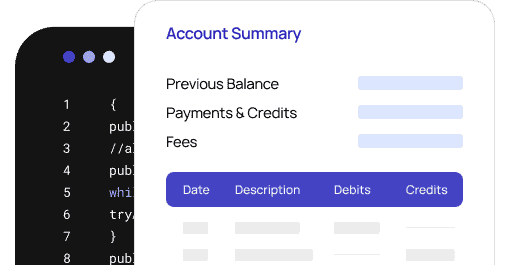

Automate statements

Automatically generate statements that are supported by our robust APR Calculator and Real-Time Ledger.

Compliance Safeguard

Ensure you’re always compliant with state-by-state regulations through pre-built guardrails in our Modern Lending Core.

Flip to installment

Provide ultimate flexibility by converting larger purchases into a simple installment loan.

Reporting Suite

Monitor every detail of your credit card portfolio by generating timely and accurate reports with LoanPro’s Reporting Suite.

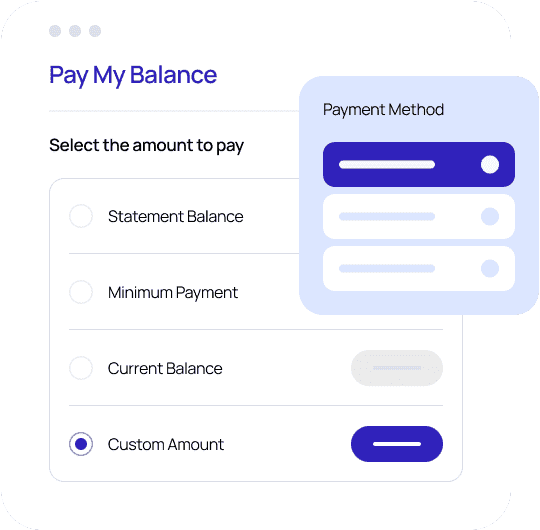

Customer Portal

A fully customizable borrower experience to complete any desired self-service action.

Launch truly differentiated credit card programs

LoanPro’s API-first, configurable architecture allows our customers to launch targeted, differentiated credit card programs. Here are a few examples.

Consumer cards

Active military duty card

Borrower experience:

- Lower interest rates on geofenced spending: Groceries and gas within a five mile radius of home incur a reduced 3% interest rate during deployment.

- On base promotions: A reduced 7% interest rate for Commissary and BX purchases.

- Family support: One-time $500 statement credit for air travel incentive to visit family during deployment.

Back-office experience:

- Flip to installment: Convert large purchases into pay-in-four installment loans with the click of a button, reducing carrying costs for you and the borrower.

- Flexible payment acceptance: Accept full or partial payments in store, online, or over the phone, whether they’re cash, card, check, or ACH.

- Payment programs: Drive repayment by offering qualifying customers due date changes, payment plans, and hardship programs.

Business credit cards

Construction card

Borrower experience:

- Convert to installment: Convert transactions or balances to installment loans to reduce cost of capital.

- Transaction-level credit: Land purchase rolled into installments with 5% interest rate, while materials remain on line of credit at 10% interest rate and labor at 15% interest rate.

- Multiple access points: Direct disbursement to borrower for amounts <$5k ($50k total). Remainder must be invoiced by contractor.

Back-office experience:

- Unique payment schedules: Create repayment schedules that align with varying merchant needs and your risk profile.

- Collateral Tracking: Associate single or multiple pieces of collateral to a line of credit to reduce risk.

- Merchant cash advance: Tie repayment directly to revenue of the business to increase differentiation and reduce default rate risk.

Co-branded credit cards

Retail co-branded card

Borrower experience:

- Store-specific rewards: Earn 5% back on all in-store purchases, 2% on online orders, 1% everywhere else.

- Exclusive access: Early access to sales, birthday bonuses, and member-only events.

- Flexible redemption: Redeem rewards as statement credit, gift cards, or donations to charity partners.

Back-office experience:

- White label branding: Complete control over card design, communications, and customer portal.

- Private label credit card options: Offer both open-loop (usable anywhere) and closed-loop (store-only) versions.

- Real-time analytics: Track cardholder purchase behavior, category preferences, and lifetime value.

Create business value with LoanPro’s credit cards as a service platform

Increase operational efficiency

Automate credit card servicing in the background to eliminate manual tasks and enable portfolio growth.

Increase customer retention & loyalty

Create experiences that delight customers, such as flip to installment, hardship programs, and more.

Drive growth

Stand out and stay ahead of the competition by launching a first-to-market program, from co-branded credit cards to private label solutions, with our patent-pending transaction-level credit innovation.

Reduce risk

Reduce losses through our Collections Suite and maintain compliance with all necessary credit card regulations with Compliance Safeguard.

Why choose LoanPro's card issuing platform

API-first

- Configurable, end-to-end platform

- Compatible with your favorite issuers, partners, and tools

Compliance

- Keep on top of compliance needs, including CARD Act and SCRA requirements

- Vetted solutions ensure your road to compliance comes with guardrails

Configurability

- Support card programs of any type, from consumer cards to business lines

- Ensure that your potential for growth is limited only by your imagination, not your software

Scalability

- Scale your business without growing pains

- Support millions of credit cards from one, unified system

Related credit programs

Installment loans

Create unique personal installment loans to differentiate in a crowded market.

Answers to your questions about our card issuing solution

Frequently asked questions

What is a card issuing platform?

A card issuing platform is the complete technology infrastructure needed to launch and manage credit card programs from end to end.

Issuing processors (like Lithic, Galileo, or Visa DPS) handle card creation, transaction authorization, and network connectivity. But credit card programs also require a system of record to manage the lending side: tracking balances, calculating interest, generating statements, processing payments, and handling collections.

LoanPro provides that credit ledger and servicing layer. We integrate with issuing processors so you can manage your entire credit card program from one platform—configuring interest rates, billing cycles, payment workflows, and collections without building custom infrastructure.

What's the difference between co-branded and private label credit cards?

Co-branded credit cards partner a brand with a bank (like Delta Amex). They work anywhere and feature both logos. Customers earn enhanced rewards at the partner but can use the card everywhere.

Private label credit cards are store-only cards (like Target REDcard). No major network logo—just the retailer's brand. They're "closed-loop," meaning they only work at that specific store or brand family.

LoanPro supports both program types on one platform.

What credit card software is needed to launch a card program?

Three essential components:

- Credit ledger and servicing platform (like LoanPro) — Manages account balances, interest calculations, billing, statements, and collections

- Issuing processor (Lithic, Galileo, Visa DPS) — Creates cards, authorizes transactions, and connects to card networks

- Payment processing — Handles customer payments to pay down balances (PCI-compliant)

LoanPro provides #1 and #3 while integrating with any issuer for #2, giving you complete infrastructure without building from scratch or vendor lock-in.

Can you issue virtual cards with a card issuing platform?

Yes. Modern card issuing platforms support instant virtual card issuance for online transactions, digital wallets (Apple Pay, Google Pay), and business expense management.

With LoanPro, you can:

- Issue virtual cards instantly for immediate use

- Support single-use cards for enhanced security

- Power BNPL programs with virtual provisioning

- Manage both physical and virtual cards in one system

LoanPro handles the servicing and account management while integrating with issuing processors who create and deliver the virtual cards.

How do card issuing platforms ensure CARD Act compliance?

Card issuing platforms like LoanPro use built-in Compliance Safeguard tools that automatically enforce CARD Act requirements—no custom development needed.

Key protections include:

- Automatic APR disclosures and accurate statements

- Payment allocation rules (high-to-low interest rates)

- 45-day advance notice for rate changes

- Fee limitation enforcement

- Complete audit trails for regulatory exams

Our platform stays compliant with CARD Act, SCRA, and Reg Z through automatic updates as regulations change, protecting you from fines and reducing compliance risk.

What's the difference between a card issuing platform and credit cards as a service (CaaS)?

A card issuing platform is the technology (the engine), while credit cards as a service (CaaS) is the business model that platform enables.

CaaS lets businesses offer branded credit cards to customers without becoming a bank or building the infrastructure themselves. Fintechs, retailers, and brands use CaaS to launch co-branded or private label programs in weeks instead of years.

LoanPro is the card issuing platform that powers CaaS for any business model.

Launch first-to-market credit card programs that drive growth.

Talk with our team about launching your credit card program with LoanPro today